HOLIDAY SHOPPING: THE STATE OF THE STATES

With the COVID-19 pandemic continuing to spread in almost every state, US retailers are not alone in facing the prospect of a long winter. They are, however, likely to be particularly sensitive to the effects of fresh shutdowns and reduced spending from consumers over the remainder of the critical holiday season—with the location being one of the key factors dictating just how steep the falloff will be.

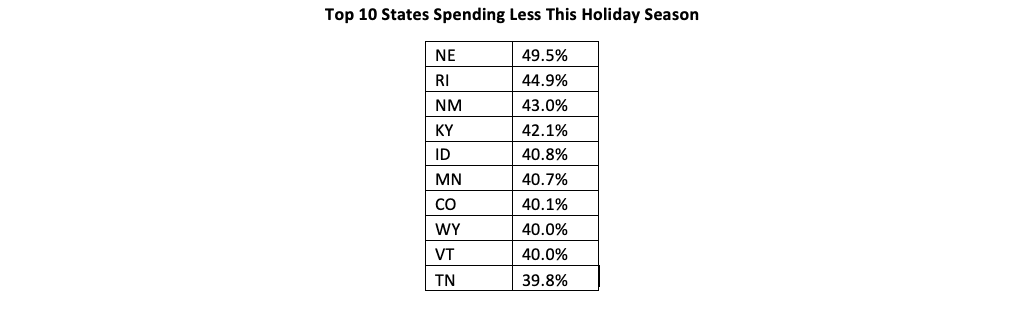

Research from What If Media Group, a performance marketing firm, suggests that consumers in different parts of the country are experiencing the effects of the pandemic differently, and responding to it differently in economic terms. While a previous What If Media Group report found that 37.7% of consumers nationwide were planning to spend less this year than last year, spending intentions vary widely by state. For example, almost half of survey respondents in Nebraska are planning to spend less, compared to just 29.2% of residents of Maine—results that underline the importance of data-driven decision-making when it comes to segmentation across every stage of the buying journey. In addition, consumers in Rhode Island, New Mexico, and Kentucky were significantly more likely to be intending to cut costs than the median.

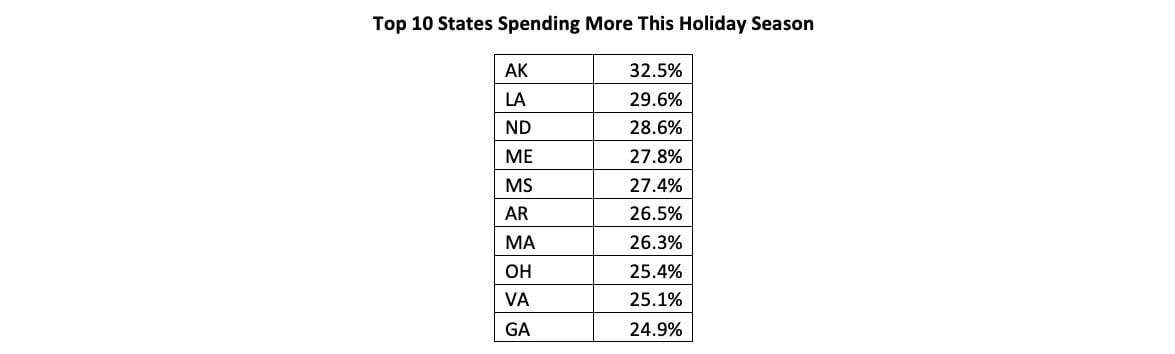

Retailers seeking bright spots can find some comfort in the fact that almost a quarter of Americans are planning to spend more this holiday season than last year. Those pushing the boat out are most likely to live in Alaska, where 32.5% of residents indicated that their holiday spend would likely be higher in 2020 than last year.

Availability Concerns

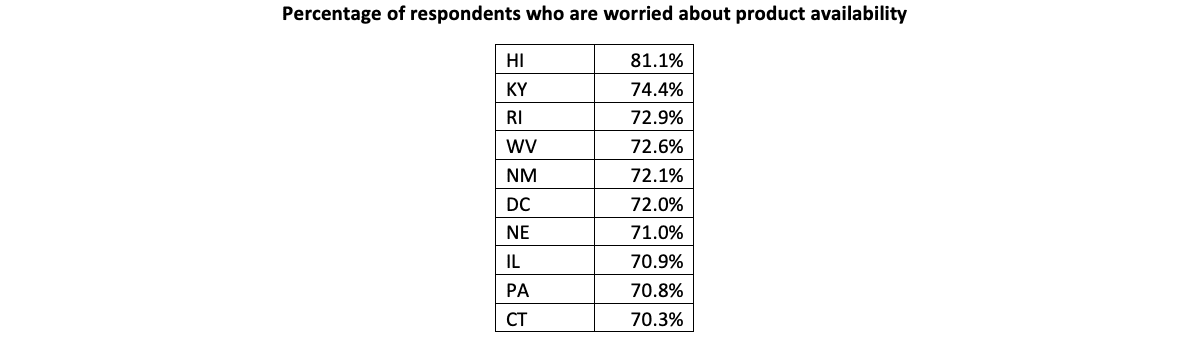

Despite the downturn in spending intent, many Americans remain concerned about their ability to secure the gifts they want during this season due to COVID-19 related disruptions to the supply chain. Perhaps unsurprisingly, given its remote nature, Hawaii tops the list with 81.1% of respondents reporting feeling somewhat or very worried about product availability.

Store choices

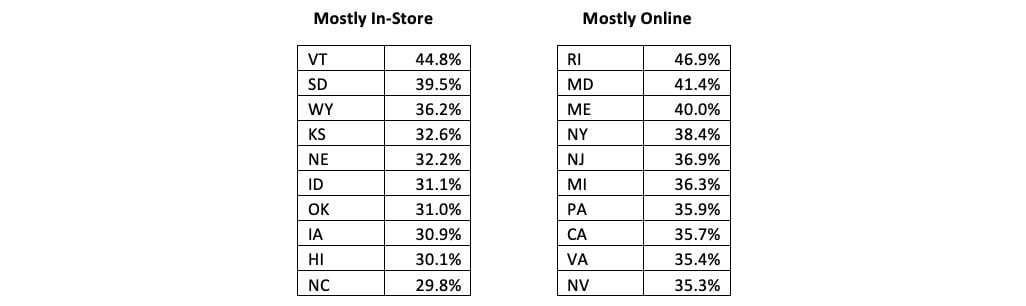

One way that consumers can take control of their ability to get the products they need is by shopping online—and here, too, the What If Media Group survey uncovered some significant differences by state. While consumers in states with relatively small populations—including Vermont, South Dakota and Wyoming—signaled that they were more likely to conduct the majority of their gift shopping in physical stores, consumers in more densely populated states such as New York and California were more likely to predict doing the majority of their shopping online.

However, density alone is not enough to predict likely shopping patterns—consumers in states including Rhode Island, Maryland and Maine, which have had some of the most aggressive anti-COVID policies in the nation since the outset of the pandemic, were the most likely to opt for the online experience, underlining once again the importance of gaining multiple data points on which to base marketing decisions.

Methodology

The What If Media Group survey was conducted online within the United States from October 26 to October 27, 2020, and surveyed 37,179 adults. Respondents were randomly selected and the findings are at a 99% confidence level with a margin of error +/- 2.5%. What If Media Group’s proprietary ad-serving technology includes a real-time survey module that was used to facilitate the data collection for this study. Data was weighted to the 2010 US Census.

About What If Media Group

Founded in 2012, What If Media Group is an award-winning performance marketing company that enables the world’s leading brands to acquire valuable new customers at scale. By leveraging data-driven engagement and re-engagement strategies across multiple proprietary marketing channels and sophisticated targeting technology, and utilizing insights based on millions of consumer ad interactions each day, What If Media Group delivers the most cost-effective and highest performing marketing campaigns for its clients. Headquartered in Fort Lee, New Jersey, What If Media Group is a recipient of Crain’s 2019 Fast 50 and is a member of the Inc. 5000 list of the fastest-growing private companies in America.